RP Dunk & Co Taxation

RP Dunk & Co offers comprehensive tax services tailored to meet the needs of individuals, businesses, and not-for-profit organisations. With a strong focus on accuracy, compliance, and proactive planning, our experienced team helps clients navigate the complexities of the Australian tax system while maximising outcomes. At RP Dunk & Co, we combine technical knowledge with personalised service to deliver practical, results-driven tax solutions. Whether you’re a sole trader, small business owner, investor, or non-profit organisation, we’re here to help you stay compliant and financially confident.

Taxation Services

✓ Individual & Business Tax Returns – Timely preparation and lodgement of personal and business tax returns, ensuring compliance with the latest legislation and ATO requirements.

✓ BAS & GST Services – Assistance with Business Activity Statements (BAS) and Goods and Services Tax (GST) obligations to ensure accurate reporting and avoid penalties.

✓ Fringe Benefits Tax (FBT) – Expert advice on FBT reporting, compliance, and strategies to manage fringe benefit liabilities.

✓ Capital Gains Tax (CGT) – Guidance on the tax implications of selling assets, including property and shares, with strategies to minimise CGT liabilities.

✓ Tax Planning & Minimisation – Strategic planning to help clients reduce tax legally, improve cash flow, and make informed financial decisions.

✓ ATO Liaison & Compliance – We act on your behalf in dealings with the ATO, including audits, payment arrangements, and resolving disputes.

✓ Entity Structuring for Tax Efficiency – Advice on choosing the most effective business structure (sole trader, company, trust, partnership) to suit your goals and minimise tax obligations.

Trusted Partners & Accrediations

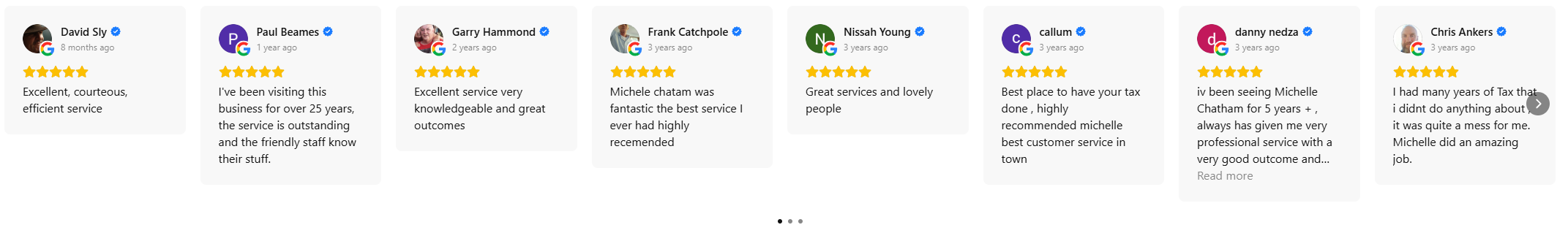

HAPPY CLIENTS